success stories

development + investment

The City of Peoria

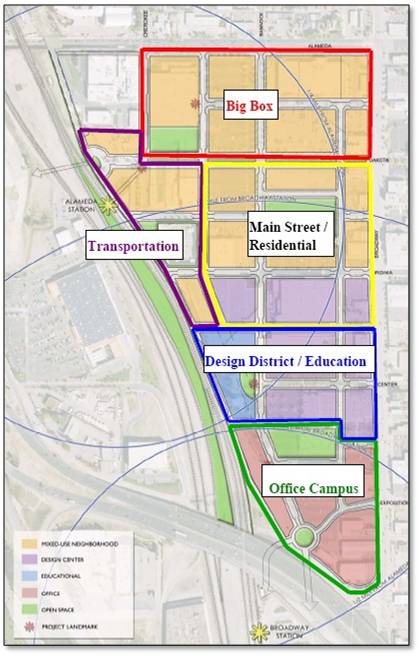

Peoria Sports Complex District Urban Design Plan

The overall purpose of the Peoria Sports Complex District Urban Design Plan is to explore urban and environmental design solutions to a variety of opportunities and challenges within the existing mixed use core area.

The role of The London Group was to perform and Economic Market and Financial Feasibility Analysis.

The Economic Market Analysis analyzed the regional (northwest valley) and local market. The analysis included the following elements: Inventory of existing uses in the market area and forecasted build-out, study area location attributes (demographic structure and trending, absorption and pricing trends of competing projects), evaluation of the economic environment of the regional and local markets including supply and demand dynamics and an appropriate product mix and absorption schedule for the study area, and identification of a competitive position of other similar development area and an identification of existing and optimal residential, office, retail and entertainment uses and densities within the study area.

The Financial Feasibility Analysis determined financial feasibility of the project over its build-out period. The proforma statements demonstrated the build-out timeline while focusing detailed analysis on catalytic projects in the study area. It also determined the fiscal impact of the proposed redevelopment program, provided tools and incentives to develop strategies to promote and encourage further redevelopment, including private investment and public/private partnerships, and identified the approaches the City can use to fund infrastructure and public improvements.

The Denver Design Center

Denver, Colorado

This ongoing transit oriented development consists of over 70 acres located 1.5 miles from downtown Denver along major light rail corridors. Upon full build-out this project is projected to be a total of 8 to 10 million square feet of residential, retail, office and hospitality uses. The London Group’s role was to perform a comprehensive market analysis study and determine financial feasibility on the project. In doing so, The London Group conducted extensive market analysis to determine supportable densities and appropriate mix of uses, financial analysis to determine residual land values and acceptable returns for investors, and analyze the financing structures and public funding mechanisms available to the project.

An economic analysis was also performed to identify anchor tenants and businesses that could “seed” the project. This resulted in creating a first development phase focused around a mass transit rail and bus system.

South Broad Street

San Luis Obispo, California

The focus of this project was to create a financially feasible land plan that could be immediately implemented for the redevelopment of downtown San Luis Obispo. The 140-acre study area was targeted for redevelopment to create a walkable, vibrant and commercially active corridor in a higher density setting. The London Group’s role was to conduct an analysis of the economic impact of the redevelopment, determine appropriate development intensities, recommend a mix of uses and potential tenants and recommend tools and incentives to promote and catalyze private investment.

The focus of this project was to create a financially feasible land plan that could be immediately implemented for the redevelopment of downtown San Luis Obispo. The 140-acre study area was targeted for redevelopment to create a walkable, vibrant and commercially active corridor in a higher density setting. The London Group’s role was to conduct an analysis of the economic impact of the redevelopment, determine appropriate development intensities, recommend a mix of uses and potential tenants and recommend tools and incentives to promote and catalyze private investment.

Civica Development – Goodyear Ballpark Village

Civica Development (formerly Rose Properties) developed a 150 acre site in Goodyear, Arizona, consisting of a 10,000 seat spring training ballpark for the Cleveland Indians and a corporate office campus. The London Group’s role was to make strategic planning recommendations and perform a comprehensive analysis of the market including market feasibility, pricing and absorption.

A macro-economic analysis was conducted in early planning stages to demonstrate how Goodyear “fits” economically as a submarket of the West Region. An East vs. West analysis of economic factors was also conducted to demonstrate historical growth patterns and inform our longer range forecasts for the Phoenix region, West sub-region, and City of Goodyear.

A financial analysis was also conducted that analyzed the public/private partnership between the landowner, developer, and city.

Gresham Savage Nolan Tilden – Wal-Mart Supercenter & Expansion Economic Impact Analysis

Gresham Savage Nolan Tilden hired The London Group Realty Advisors to conduct studies to determine the market opportunity, economic and fiscal impacts of various Wal-Mart Supercenter projects and Wal-Mart site expansions. The London Groups role was to specifically utilize our analysis to assist in the strategic planning for the project, as well as for development processing and entitlement documentation requirements.

expansions. The London Groups role was to specifically utilize our analysis to assist in the strategic planning for the project, as well as for development processing and entitlement documentation requirements.

The following are some of the key questions answered: What is the market opportunity to develop the Wal-Mart project in the local market? What is the current projected level of competitive supply and demand in the market area? Is there sufficient market opportunity to justify this Wal-Mart project and additional Wal-Mart stores that are being planned and proposed in the greater region? What is the anticipated Fiscal Impact of the proposed project including net sales tax increases?

ANKA Property Group – Pricing Studies/Bulk Sale Analysis/Litigation Support/Mediation

For various condominum developments, The London Group Realty Advisors conducted research to provide analysis relating to the evaluation of the projects. Our work included real estate and financial analysis and evaluation of pertinent information, documents and reports.

Work included research, analysis, consultation, document analysis and assistance in preparation of a case.

GoBuild – Story Mill-Bozeman, Montana

Story Mill is a proposed mixed-use infill redevelopment project on 106 acres in the northeast quadrant of Bozeman, Montana.

The London Group’s role was to create financial models combining existing assets and potential future developments to use as a framework for strategic decision making and financial underwriting, analyze the market potential for development of the property to specifically determine the best mix, timing and scale of the various land use alternatives, evaluate the competitive landscape to identify a unique product positioning strategy, analyze demographic and economic trends, as well as existing supply in the market to make specific project recommendations for all product types (recommendations will include pricing, unit sizes, amenity packages, target market, etc.), conduct feasibility analysis to determine the best financial options and potential returns for the most likely development scenarios, and conduct a phasing analysis considering maximization of cash flow and feasibility of development based on competitive market conditions.

Following the completion of our initial findings, we evaluated the different ways they could develop or venture, as well as evaluated disposition strategies and suggested ideas on deal structuring to retain capital gains and maximize profitability. We established the most efficient capital structure to reduce ownership exposure and gain access to the lowest cost capital available.

Mountain West Real Estate – Tax Increment Calculations

The London Group’s role was to conduct various real estate analysis to support the Gateway project in downtown Chula Vista, CA. We conducted the necessary analysis to determine the tax increment numbers for the Gateway Chula Vista project. Our analysis included a determination of the economic benefit of the projects as well as employees, wages and sales tax revenue.

Medina Investments and Development – Fiscal Impact Analysis

The London Group’s role was to conduct a Fiscal Impact Analysis on behalf of a planned entertainment venue project in Long Beach, CA.

After understanding the probable type, size and revenue generating capability of the proposed use of the subject project, we determined the revenues that can be achieved by the City including sales tax, property taxes, tax increment or any other prospective revenues and economic benefit to the City from the planned project.

We calculated property tax revenues for the project and determined the City’s share of the taxable revenues, calculated the tax increment that will be generated by the project, determined the revenue generated and taxable retail expenditures and the City’s share of commercial retail revenues, determined the impact on transient occupancy revenue, parking garage revenue and the long term fiscal and economic impacts of the proposed project.

Pacific Marine Credit Union – Bank Expansion Market Analysis![]()

The purpose of this project was to conduct market analyses to assess the opportunity to expand Pacific Marine Credit Union’s operations by adding branch locations in targeted markets.

The London Group’s role was to determine which selected markets might represent candidate expansion opportunities, and to create a priority list based on these analyses. In order to do this, The London Group performed the following tasks: defined the markets, determined the supply of competitive financial institutions in the markets, extract the demographic information that would reflect the current and future demand for financial institution in these markets, and reconcile the supply and demand data to determine the overall potential for Pacific Marine Credit Union expansions as well as the preferred locations.

Rancho La Puerta – Wellness Center – Tecate, Mexico

The London Groups provided strategic planning, market and feasibility for the 3,000-acre Rancho La Puerta site located in Tecate, Baja California, Mexico.

The London Group’s role was to analyse the market potential for development of the property to specifically determine the best product, mix, timing and scale of the various land use alternatives (includes recommendations for long-term development phasing by type of land use and location within property), conduct feasibility analyses to determine the best development, venture and financial options and potential returns for the most likely development scenarios (includes the determination of residual land value, as well as development disposition strategies, based on various development venture scenarios), and following the completion of our initial findings, we evaluated the different ways to sell or joint venture as well as evaluate the ownership position under each scenario.

Southwest Strategies, LLC – Employment Generation Analysis

The San Diego City Planning Commission has approved a Pardee Construction development consisting of 1,578 residential units on 45.97 acres gross.

The London Group’s role was to determine number number of jobs that would be generated due to the development of the project. The London Group prepared a report analyzing the Employment Generation benefits of the project. This included a projection of the level of jobs that would be generated from this project, in both its construction phase as well as in the future.

Star Ranch – Market Analysis & Investor Package

Star Ranch is a 4,760 acre master planned community located adjacent to the Cleveland National Forest in the country town of Campo.

The London Groups assignment was to determine the property value by analyzing the market potential of the proposed land use plans. To accomplish this we will update the market analysis and conduct feasibility studies to determine probable revenues of the identified land uses, as well as timing and phasing. We also determined valuation and deal points under various development and disposition options including in-house development, sale or voint venture. Our feasibility analysis determined the best financial options and potential returns for the most likely disposition scenarios. We also conducted ongoing sensitivity analysis throughout the negotiation process with prospective capital providers, buyer and ventures.

Carlsbad Prospect Point – Ocean Street Residences

Ocean Street Residences is a project that includes 18 buildings which will house 35 residences located on 3.05 acres on the north side of Ocean Street.

The London Group’s role is to determine what the opportunity is in the market when the project is completed in three years, what is the most marketable approach to the project, including marketing primary vs. secondary homes, fractional vs. fee simple, etc., and what our advice is as to the layout and amenities, recognizing that much has been accomplished in terms of project planning.

Realty Development Services – Dublin Rancho North, Colorado Springs

Realty Development Services is evaluating the development opportunities associated  with the various neighborhoods within Dublin Ranch North, an approximately 110 acre property located in Colorado Springs.

with the various neighborhoods within Dublin Ranch North, an approximately 110 acre property located in Colorado Springs.

The London Group determined the property value by analyzing the market potential of the proposed land use plans by conducting market studies which determined probable revenues of the identified land uses, as well as timing and phasing. We also advised on various disposition options including in-house development, sale or joint venture. Determine valuation and deal points under each scenario by conducting a feasibility analysis to determine the best financial options and potential returns for the most likely disposition scenarios. The London Group also conducted on going sensitivity analysis throughout the negotiation process with prospective capital providers, buyers and ventures.

in3 Group – La Jolla 4-Plex

in3 Group completed plans to develop four residential condominiums on a 4,800 square foot property located in La Jolla, CA.

Our assignment included an analysis of current sales activity in the market for both existing homes and new, comparable projects. The goal was to determine the project’s market positioning, achievable revenues and anticipated absorption schedule. We also analyzed the state of the market to determine a strategic time to begin development. In order to achieve these objectives we provided all services, analysis and consultation necessary to determine the best development opportunity from a strategy, market and financial feasibility perspective.

San Miguel Ranch – San Luis Obispo

San Miguel Ranch is located on 550 acres and has 345 residential lots and 44 residential multi-family units as well as commercial retail land uses planned on site.

The London Group’s role was to determine the property value by analyzing the market potential of the proposed land use plan through market studies to determine probable revenues of the identified land uses, as well as timing and phasing. We also advised on various disposition options including outright sale, phased sale or joint venture. We determined the valuation and deal points to negotiate with a buyer. To inform this, we conducted a feasibility analysis to determine the best financial options and potential returns for the most likely disposition scenarios. We conducted an ongoing sensitivity analysis throughout the negotiation process with a prospective buyer or venturer.

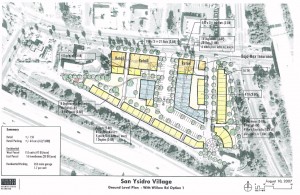

San Ysidro Village – San Ysidro, CA

San Ysidro Village is a planned 220 residential unit and 15,000 square foot commercial retail development in San Ysidro, CA. The London Group’s role was to provide a strategic development analysis to determine its development potential, value and entitlement strategy.

In order to assess the development opportunity we conducted the necessary market and feasibility analyses to evaluate the prospective development opportunities. We also prepared financial proformas to evaluate the prospective financial outcome of various development and disposition scenarios. After completing our research and analysis, we provided consultation regarding development strategy and entitlements which included reviewing efforts to achieve acceptable land use designations and assistance.

Strata Equity Group – Financial Analysis

The London Group Realty Advisors provided financial models and ongoing analyses for Strata Equity Group. Our assignment was to create new Microsoft Excel based spreadsheets and provide ongoing analyses to both refine and employ those spreadsheets as part of the clients due diligence to determine the best financial options and potential returns for the most likely entitlement scenarios, residual land value, and disposition strategies.

San Diego Wild Animal Park – San Diego, CA

The London Group’s role was to conduct a market and feasibility analysis, recommended framework to accomplish the development of a proposed resort hotel at the San Diego Wild Animal Park.

In order to accomplish this task, we conducted an independent market and feasibility analysis to determine the opportunity which included a background of the market, supply analysis, demand analysis, and market share and reconciliation. We also prepared a Request for Proposal to interested developers and operators, created a structure for reviewing those proposal, and assisted in their evaluation.

5030 College Ave – San Diego State Student Housing Analysis

The London Group evaluated the development of two properties including one 1.56 acre parcel designated for a Sorority housing development of 525 best and a 0.72 acre parcel designated for a fraternity house of 244 beds.

The London Groups role was to determine the size and scope of the market, and its consequences with respect to rental rates, segmentation, marketing and design approach.

Constellation – Lumina Tempe

Lumina Tempe, includes a 16 level tower on a one level podium building over three levels of underground parking. The tower and podium design is comprised of 27 residential condominiums on the top three levels, a 220 room hotel, and 42,813 square feet of entertainment and leisure facilities providing amenity and services to both the hotel guests and residential occupants.

The London Groups role was to review all plans and specifications, marketing materials, developer project pricing and project timeline. Investigate and access the market supply and demand conditions, economic, demographic, migration and lifestyle trends pertinent to the project. Evaluate of the number of residential condominiums, mix, condo layouts, proposed design of the base building and the specification proposed as it relates to the market as well as the assessment of future competitive projects. Provide recommended retail pricing for the condominiums as well as projected absorption. Make recommendations including strategic marketing plan and a critical evaluation of the proposed unit mix and market opportunities.

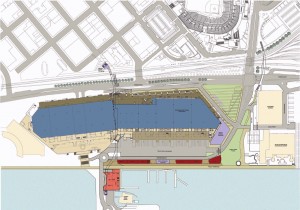

San Diego Convention Center – Retail Analysis

The London Group prepared a retail market demand study to quantify the supportable demand for the proposed retail center on the Fifth Avenue Landing site.

The London Group’s role was to determine house much retail volume can be achieved annually, what is the composition and size of the target market, how can we target this market so that its potential is maximized, and how do the experiences of other major retailers in this market translate to the sites prospective experience. To accomplish this, we did a supply and demand analysis of the local retail and combined the supply and demand information to determine the amount of excess capacity for retail expenditures in the market that might be targeted by the proposed project.

Sun Country Builders – Industrial Market Analysis & Investor Package

The London Groups completed an analysis of the local market, as well as analogues to determine the most marketable approach, given the clients objectives. This included an examination of the supply and demand factors at play in the market. We also conducted a comprehensive financial study to determine the most profitable disposition option, as well as determined the maximum land values and revenues. Once our work was completed, we packaged the deal to attract the attention of acquirers, venture partners, capital sources and lenders and continued to advise on project repositioning.

Arens Group, Inc – Retail and Office Market Analyses

The London Groups role was to determine the amount of retail and office space that could successfully be developed on various parcels of land. We also advised on the type of tenants that should be targeted for the retail and office developments.

Archstone Mission Gorge – Apartment Analysis

Representative Developer and Real Estate Clients

The Allen Group

Grupo Lagza

Anka

Barratt Homes

Cushman and Wakefield

Cousins Properties

Equity Office

Lennar

JMI Realty

LandGrant Development

The Corky McMillan Companies

Noble

The Olson Company

Representative Legal Clients

Stroock & Stroock & Lavan

Latham & Watkins

Higgs Fletcher & Mack

DLA Piper

Luce Forward Hamilton & Scripps

MoFo

Kirby Noonan Lance & Hodge

Procopio Cory Hargreaves & Savitch

Solomon Ward Seidenwurm & Smith

Sullivan Hill Lewin Rez & Engel

Representative Public Agencies and Organizations

County of San Diego

City of Poway

SDG&E

SDSU

UCSD

City of Peoria, AZ

City of Goodyear, AZ